What Types of Taxes Do You Pay on Home Sale Proceeds When Selling a House In PA?

When selling a house in Pennsylvania, there are two main categories of tax that typically apply to the cost of selling a house in PA.

- Capital Gains Taxes – This is federal tax applied to the profit you realize when selling a property or investment in the United States. Any time you sell your home for more than its cost-basis, this tax applies.

- Transfer Taxes – Typically done at the state and local levels, these taxes are imposed when real property exchanges hands. It’s very common for transfer taxes to be expressed as a percentage of the total sale price.

This guide is for Pennsylvania homeowners considering a sale of their property. It will breakdown each of these two into more detail and help you estimate what you might owe when selling your own house.

However, before we get too far, it is important to point out that it is possible that there may be additional tax implications for selling your home that are not considered here.

Consulting a licensed attorney or CPA would provide the most comprehensive understanding of your potential tax liability – especially if you believe that there are some uncommon taxes related to the sale of your property.

As we work our way through capital gains and transfer tax, I will provide examples assuming a subject property location of Philadelphia, PA.

Philadelphia is an area that my team and I have the best understanding and knowledge of. We know the tax landscape fairly well and can speak definitively on what to expect.

Our company buys houses with cash in Philadelphia, which means we see the settlement statements on hundreds of transactions a year. If there is any tax we know really well, it would be that generated from the sale of homes in Philadelphia.

Capital Gains Tax In Pennsylvania

Capital gains tax, a tax on the profit from the sale of any real property/investment, is not unique to real estate. In fact, you can trigger capital gains tax at both the federal and state level on any income or gain you earn from all different kinds of investments and transactions:

- Real estate

- Stocks

- Crypto

- Gold and Silver

- Antiques

- Businesses

If you sell a home in Pennsylvania for more than your cost basis, then there are two types of capital gains tax that could trigger:

Federal Capital Gains Tax & PA State Capital Gains Tax.

Let’s jump into both to see what they mean.

Your capital gains tax rate is a function of your income level and other personal filing attributes. It can fall anywhere between 0% and 28%. On average, homeowners who sell their homes may be subject to 15% federal capital gains tax.

Federal Capital Gains Tax When Selling Property In Pennsylvania

No matter where you sell your house in America, there is no escaping federal capital gains tax.

And for residents of Philadelphia, PA, it’s no different.

There are two discrete applications for federal capital gains tax and only one of them can apply to your selling situation.

- If you have owned your home for less than one year, then short-term capital gains tax will apply.

- If you have owners your home for greater than one year, then long-term capital gains tax will apply.

Short-term capital gains are taxed as ordinary income and result in higher taxes than long-term capital gains.

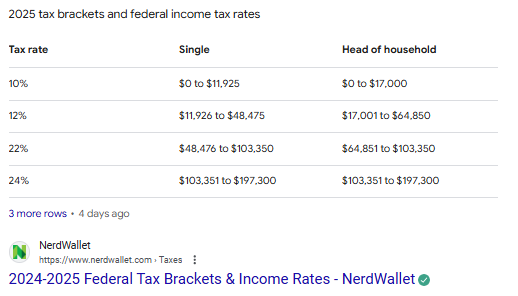

If your selling situation is going to trigger an ordinary income tax from the IRS (i.e., a short-term capital gains tax), then you can easily look up the IRS’s tax tables in a given year to see what rates are going to apply.

They do change annually, but we have found that NerdWallet does a fantastic job on continuing to update the rate schedule.

For homeowners with long-term capital gains tax implications, it gets slightly more complicated.

Here’s how to break it down:

- You can pay 0% if the following criteria is met:

- You file “Single” or “Married Filing Separately” and the taxable income is $41,675 or less.

- You file “Married Filing Jointly” or “Qualifying Surviving Spouse” and the taxable income is less than $83,350.

- You file “Head of Household” and the taxable income is $55,800 or less.

- Unfortunately, you’re on the hook for 15% tax if:

- You file “Single” and the taxable income is between $41,675 and $459,750.

- You file “Married Filing Jointly” or “Qualifying Surviving Spouse” and the taxable income is between $83,350 and $517,200.

- You file “Married Filing Separately” and the taxable income is between $41,675 and $258,600.

- You file “Head of Household” and the taxable income is between $55,800 and $488,500.

Bear in mind, the above “taxable income” amounts are not just those generated from the sale of your property but also of any other personal or business income that gets reported annually.

Many homeowners may qualify for complete exemption of capital gains tax if the house was used as their primary residence for at least 2 out of the last 5 years before they sold the property. Limits apply.

Federal capital gains tax is usually the largest amount of dollars coming out of your pocket at closing. Now that we’ve gotten that one out of the way, let’s move to Pennsylvania State Capital Gains Tax.

State Capital Gains Tax When Selling Property In Pennsylvania

State capital gains tax in Pennsylvania is much simpler than the federal rate schedule.

In the Keystone state, your capital gains are treated as personal income.

For example:

If you sold a house that generated a non-exempt taxable gain of $50,000. And if in that same year, you also earned $100,000 from your W2 salaried job. Then you would have a total taxable income of $150,000.

And in that case, Pennsylvania slaps a 3.07% flat tax on all income. There are no tax brackets or progressive income schedules to compute. All income is taxed at 3.07%.

Concluding the above example, total PA State Income Tax due would be $4,605 (including state capital gains tax).

That about sums it up for all PA state capital gains and income tax that could be generated from the sale of your home in Pennsylvania.

What’s left is any transfer tax that the state and local jurisdiction (i.e., city) might levy on your transaction.

Transfer Tax In Pennsylvania

Transfer tax or Realty Transfer Tax (RTT), the fees rendered by state and local governments when property transfers, is a fixed percentage amount levied on the sale price of your home in Pennsylvania.

And in some cases, it can be a significant part of the overall transaction cost in PA when selling a house. It’s important as a seller to understand these costs in Pennsylvania and how they typically split out:

- State applied RTT

- Locally applied RTT

From our above assumption, we will continue using Philadelphia, PA as our location and from there illustrate what amount could be owed when selling your home.

Although each city and county in Pennsylvania is a little bit different than the other, it’s always best to look up your property’s location to be as accurate as possible.

We update the transfer tax by county in Pennsylvania table each year so you can be fairly confident that these numbers will work for your estimates.

Let’s walk through how each of these transfer taxes work.

State Transfer Tax When Selling Property In Pennsylvania

State transfer tax in PA is computed as 1% of the property’s value.

That’s the bad news.

The good news is that this amount is customarily split between buyers and sellers in Pennsylvania. This means, in a standard transaction, the seller typically pays half of the transfer tax from the property’s sale value.

For example:

If Paul sells his home in Philadelphia, PA for $300,000, then he can expect to pay $3,000 in total state transfer tax. Under a traditional sale, this amount would be split 50-50 between the buyer and seller. Paul will owe $1,500 in Pennsylvania Transfer Tax and his buyer would cover the remaining $1,500. That is, of course, as long as the buyer agrees to.

Local Transfer Tax When Selling Property In Pennsylvania

Local transfer tax is an additional tax levied by county and/or township in Pennsylvania.

It’s not a substitute for PA State Transfer Tax, but an incremental amount.

Therefore, in addition to the 1% that the state collects, you can add on top of that another percentage based on your county and township.

For Philadelphia, the local transfer tax rate is 3.578%. It’s among one of the highest in country when it comes to local transfer taxes.

Why, you may ask?

Transfer taxes are important to help fund local amenities, school systems and public works. Some counties across the US charge more and some less, but you typically get what you pay for.

More taxes, in general, should mean safer and higher quality of life. For some residents of Philadelphia’s most dangerous neighborhoods, it doesn’t always feel that way.

If Philadelphia is not your location and you’re selling a home in another county or township, then you’ll want to look up your details in this table below.

Transfer Tax By County In Pennsylvania

The transfer tax rates listed below are based on researched average costs collected from public records and industry surveys.

Pennsylvania Transfer Tax Rates Table:

| Location | County & Township | PA State | Total |

|---|---|---|---|

| Adams County | 1.00% | 1.00% | 2.00% |

| Allegheny County | 1.00% | 1.00% | 2.00% |

| Bellevue Borough | 1.50% | 1.00% | 2.50% |

| Bethel Park Municipality | 1.50% | 1.00% | 2.50% |

| Greentree Borough | 1.50% | 1.00% | 2.50% |

| Hampton Township | 1.50% | 1.00% | 2.50% |

| McCandles Township | 1.50% | 1.00% | 2.50% |

| City of McKeesport | 2.00% | 1.00% | 3.00% |

| Monroeville Municipality | 1.50% | 1.00% | 2.50% |

| Mt. Lebanon Municipality | 1.50% | 1.00% | 2.50% |

| Mt. Oliver Borough | 2.00% | 1.00% | 3.00% |

| O’Hara Township | 1.50% | 1.00% | 2.50% |

| Penn Hills Municipality | 2.00% | 1.00% | 3.00% |

| Pine Township | 1.50% | 1.00% | 2.50% |

| City of Pittsburgh | 5.00% | 1.00% | 6.00% |

| Upper St. Clair Township | 1.50% | 1.00% | 2.50% |

| West Deer Township | 1.50% | 1.00% | 2.50% |

| Whitehall Borough | 1.25% | 1.00% | 2.25% |

| Armstrong County | 1.00% | 1.00% | 2.00% |

| Beaver County | 1.00% | 1.00% | 2.00% |

| Bedford County | 1.00% | 1.00% | 2.00% |

| Berks County | 1.00% | 1.00% | 2.00% |

| City of Reading | 4.00% | 1.00% | 5.00% |

| Blair County | 1.00% | 1.00% | 2.00% |

| Bradford County | 1.00% | 1.00% | 2.00% |

| Bucks County | 1.00% | 1.00% | 2.00% |

| Butler County | 1.00% | 1.00% | 2.00% |

| Cambria County | 1.00% | 1.00% | 2.00% |

| Cameron County | 1.00% | 1.00% | 2.00% |

| Carbon County | 1.00% | 1.00% | 2.00% |

| Centre County | 1.00% | 1.00% | 2.00% |

| Ferguson Township | 1.75% | 1.00% | 2.75% |

| State College Borough | 2.00% | 1.00% | 3.00% |

| Taylor Township | 0.50% | 1.00% | 1.50% |

| Chester County | 1.00% | 1.00% | 2.00% |

| City of Coatesville | 2.50% | 1.00% | 3.50% |

| Tredyffrin Township | 1.50% | 1.00% | 2.50% |

| Clarion County | 1.00% | 1.00% | 2.00% |

| Clearfield County | 1.00% | 1.00% | 2.00% |

| Clinton County | 1.00% | 1.00% | 2.00% |

| Colebrook Township | 0.50% | 1.00% | 1.50% |

| East Kating Township | 0.50% | 1.00% | 1.50% |

| Columbia County | 1.00% | 1.00% | 2.00% |

| Crawford County | 1.00% | 1.00% | 2.00% |

| Borough Of Edinboro | 1.50% | 1.00% | 2.50% |

| Cumberland County | 1.00% | 1.00% | 2.00% |

| Dauphin County | 1.00% | 1.00% | 2.00% |

| Delaware County | 1.00% | 1.00% | 2.00% |

| Radnor Township | 1.50% | 1.00% | 2.50% |

| Upper Providence Township | 2.00% | 1.00% | 3.00% |

| Elk County | 1.00% | 1.00% | 2.00% |

| Erie County | 1.00% | 1.00% | 2.00% |

| Fayette County | 1.00% | 1.00% | 2.00% |

| Forest County | 1.00% | 1.00% | 2.00% |

| Franklin County | 1.00% | 1.00% | 2.00% |

| Fulton County | 1.00% | 1.00% | 2.00% |

| Greene County | 1.00% | 1.00% | 2.00% |

| Huntingdon County | 1.00% | 1.00% | 2.00% |

| Indiana County | 1.00% | 1.00% | 2.00% |

| Jefferson County | 1.00% | 1.00% | 2.00% |

| Juniata County | 1.00% | 1.00% | 2.00% |

| Lackawanna County | 1.00% | 1.00% | 2.00% |

| City of Scranton | 3.30% | 1.00% | 4.30% |

| Lancaster County | 1.00% | 1.00% | 2.00% |

| Lawrence County | 1.00% | 1.00% | 2.00% |

| Lebanon County | 1.00% | 1.00% | 2.00% |

| Lehigh County | 1.00% | 1.00% | 2.00% |

| Luzerne County | 1.00% | 1.00% | 2.00% |

| City of Pittson | 2.50% | 1.00% | 3.50% |

| City of Wilkes Barre | 2.50% | 1.00% | 3.50% |

| Kingston Borough | 1.50% | 1.00% | 2.50% |

| City of Hazleton | 1.50% | 1.00% | 2.50% |

| Lycoming County | 1.00% | 1.00% | 2.00% |

| Mckean County | 1.00% | 1.00% | 2.00% |

| Mercer County | 1.00% | 1.00% | 2.00% |

| City of Farrell | 2.00% | 1.00% | 3.00% |

| City of Hermitage | 2.00% | 1.00% | 3.00% |

| City of Sharon | 1.50% | 1.00% | 2.50% |

| City of Sheakleyville Boro | 0.00% | 1.00% | 1.00% |

| Mifflin County | 1.00% | 1.00% | 2.00% |

| Monroe County | 1.00% | 1.00% | 2.00% |

| Montgomery County | 1.00% | 1.00% | 2.00% |

| Montour County | 1.00% | 1.00% | 2.00% |

| Northampton County | 1.00% | 1.00% | 2.00% |

| Northumberland County | 1.00% | 1.00% | 2.00% |

| Perry County | 1.00% | 1.00% | 2.00% |

| Philadelphia County | 3.578% | 1.00% | 4.578% |

| Pike County | 1.00% | 1.00% | 2.00% |

| Potter County | 1.00% | 1.00% | 2.00% |

| Schuylkill County | 1.00% | 1.00% | 2.00% |

| Snyder County | 1.00% | 1.00% | 2.00% |

| Somerset County | 1.00% | 1.00% | 2.00% |

| Wellersburg Borough | 0.50% | 1.00% | 1.50% |

| Sullivan County | 1.00% | 1.00% | 2.00% |

| Susquehanna County | 1.00% | 1.00% | 2.00% |

| Tioga County | 1.00% | 1.00% | 2.00% |

| Union County | 1.00% | 1.00% | 2.00% |

| Venango County | 1.00% | 1.00% | 2.00% |

| Warren County | 1.00% | 1.00% | 2.00% |

| Washington County | 1.00% | 1.00% | 2.00% |

| Peters Township | 1.50% | 1.00% | 2.50% |

| Wayne County | 1.00% | 1.00% | 2.00% |

| Westmoreland County | 1.00% | 1.00% | 2.00% |

| Wyoming County | 1.00% | 1.00% | 2.00% |

| York County | 1.00% | 1.00% | 2.00% |

Now that you know your location’s specific tax amount, let’s take a look at how that impacts your net proceeds.

What Are Closing Costs in Pennsylvania?

Before we break down the calculation, it’s important to understand closing costs as well.

Here’s why:

Taxes are just one of the types of closing costs that you’ll run into when selling.

In Pennsylvania, closing costs typically include:

- Title insurance and title search fees

- Attorney fees

- Transfer taxes

- Recording fees

- Settlement or escrow fees

- Any other administrative costs required to finalize the sale

These usually run anywhere from 1% to 3% of what the house sells for.

How To Calculate Your Net Proceeds

If you’re thinking about selling your house in the Keystone state, there’s one number that really matters at the end of the day.

And that is what you’ll actually walk away with after everything’s said and done.

It the industry it’s commonly referred to as your “net proceeds”.

This is a number I am actually somewhat passionate about.

Why, you may ask?

I really wish more people understood this before they start the selling process. It’ll helps them figure out what’s realistic and make better decisions along the way. Most notably, the decision to the list the house with a real estate agent or sell it directly to a cash buyer…who typically pays all of the closing costs anyways!

Let me explain exactly how you can compute seller net proceeds. This is how I explain it to sellers who reach out to us for a quote:

1. Figure Out Your House’s Sale Price:

This is pretty straightforward, but it is whatever your buyer agrees to pay.

2. Subtract What You’ll Pay Real Estate Agents:

In Pennsylvania, you’re typically looking at around 5-6% of the sale price total, split between your listing agent and the buyer’s agent. As a seller, you bear the full burden of that.

3. Take Out Your Closing Costs:

These usually run anywhere from 2% to 3% of what the house sells for. Think title fees, attorney costs, transfer taxes. It’s pretty much all that administrative stuff you have to deal with on the settlement sheet.

4. Don’t Forget the Other Expenses:

You’ve still got to pay off whatever’s left on your mortgage, plus any property taxes you owe, and maybe some repairs or incentives you agreed to give the buyer during negotiations.

Examples of Other Expenses:

- Remaining mortgage

- Liens

- Outstanding water bills

- Unpaid contractors

- Pro-rated property taxes

- IRS tax liens

- HOE fees

Example Net Proceeds Calculation (Including Taxes)

Here’s what this might look like in real life at the closing table:

| Item | Amount |

| Sale Price | $300,000 |

| Agent Commission (6%) | -$18,000 |

| Closing Costs (2%) | -$6,000 |

| Remaining Mortgage Balance | -$100,000 |

| Net Proceeds | $176,000 |

Do You Need to Sell Your House Without Taxes or Closing Costs?

For many homeowners, especially those living in area with high transfer tax rates (Pittsburgh, Philadelphia, etc.), it may make sense to have a professional home buyer cover those costs when selling your home.

Home buyers, such as Signature Properties, pay for all of the closing costs and transfer taxes when they buy your home. This makes your life and the process overall that much easier and faster. And let’s be honest, not many sellers want to come out of pocket for those or any other kind of repairs or upgrades at closing.

For properties that are subject to the taxes, it can make a meaningful difference for the seller and keep more of their net proceeds at closing.

If you’re trying to estimate how much profit you will keep after selling your house and transfer taxes are eating away at that number, then give us a call or reach out through this form for a free no obligations cash offer:

More Blog Articles You Might Enjoy

Author: Doug Greene

Doug Greene is no stranger to all topics real estate and business. For over a decade he has been educating others and helping homeowners navigate difficult, complex problems with their property.

His work has been featured in the NY Times, Washington Post, Realtor.com, Apartment Therapy, HomeLight, Homes & Gardens and many more.

Fact Checked

Fact Checked