Home Sale Profit Calculator [Based on 2026 Data]

Estimate Your Home Sale Profit

Estimated Home Sale Profit

$0

Home Sale Breakdown:

Home Sale Price: $0

Mortgage Payoff Amount: $0

Agent Fees: $0

Repairs, Staging, & Cleaning: $0

Closing Costs: $0

Moving Costs: $0

Holding Costs: $0

Tip: For the most accurate calculation, enter your estimated mortgage balance. You can find this by checking your amortization schedule or contacting your lender for a current payoff amount, including interest and fees.

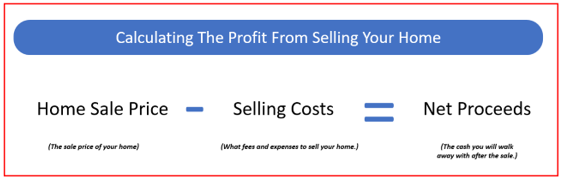

How Do I Calculate Profit From Selling My House?

The profit you make from selling your house depends on many different variables.

We captured the most common expenses above, but for you, there may be other additional costs that aren’t listed here. Of everything available in the calculator, sellers can typically expect the real estate agent commission to be the largest ($) expense. Then followed up with transfer taxes (depending on your location) and other costs (repairs, staging, settlement charges, etc.).

Of all the traditional home sales we’ve been a part of, they all follow the same math:

If you have a mortgage on your home, then you are probably familiar with what the total outstanding debt is. This total amount has to be paid off by the borrower to the mortgage lender in order to satisfy the home loan. However, there are other cost variables are where many sellers get tripped up.

Using the Home Sale Profit Calculator

Determining Your Home's Sale Price

One of the first things you need to figure out is what your house is actually worth.

And I'm not talking about what you want to get...but rather what you will get when you put it up for sale.

I work with real estate agents all the time, and the good ones will do what's called a comparative market analysis for you.

Basically, they look at houses like yours that sold recently in your area and see what's happening in your local market right now. That gives you a realistic idea of what you can actually ask for your house.

By the way, it's your house so you can "ask" for whatever price you want. But the further from reality you ask, the longer it will take for the sale to conclude.

Other Options: If a CMA through a realtor is not available to you, then you can also check some online tools to get a rough number.

Repairs, Staging & Cleaning (Average: 2%)

Selling a house requires a certain level of preparation. This is especially true if you plan to list your home with a real estate agent.

If you’re going to entertain financed offers, or offers that are backed by a mortgage and appraisal contingency, then there are certain conditions that the property must meet.

For example, you may need to make some electrical or plumbing repairs to bring the house up to code. Also, it’s very common for homeowners to repair the roof and waterproof other areas of the foundation so that there are no water intrusion issues.

Staging costs are another important expense to consider. They're not required, but if done correctly they can help you pull in a few extra dollars on your sale price.

They typically amount to around 1-3% of the home's selling price. These costs can include services like painting, cleaning, decluttering, and rental furniture.

Tip: In your listing, offer the rental furniture from the staging company at a slight markup. If staged nicely, the house might sell better "with all the furniture included".

These are all expenses that an appraiser will ask the buyer to request from the seller.

On average, these fixes cost around 2% of the home’s overall value.

Agent Fees (Average: 6%)

Even though the NAR settlement has disrupted agent commission structures in 2024, there really has not been a large change in total commissions paid by sellers.

In fact, 6% is still the average and standard realtor commission across the country.

The traditional home sale process, which includes real estate agents, draws a commission which is usually expressed as a percentage of the sale price.

It's done that way to incentivize agents to sell the property for the highest price - thereby increasing their commission. This is a very common compensation structure for sales.

The actual dollars paid in commission, however, do end up getting split between buyers and sellers agencies, then split further between salesperson and broker, and so on.

For homeowners who are really good negotiators, this is a number you might be able to get down to 5% or even better, negotiate a flat fee.

However, anything more aggressive than that is fairly uncommon.

Here’s why:

Half of the agent’s commission is actually reserved for the buyer’s agent. This means that your listing agent would only get 3% of the 6%. Reducing the total commission to an amount lower than 5% can deter buyer’s agents from wanting to even show the house to their buyers.

Closing Costs (Average: 2%)

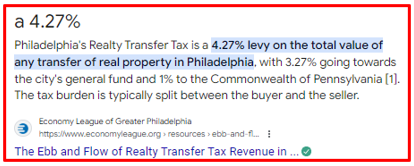

Closing costs are all of the fees associated with deed transfer, transfer tax, recording of notes, loan satisfaction, and so on.

These costs are computed and levied onto the transaction by escrow companies or closing attorneys. Not only is it important to have these neutral third-parties manage the process and funds, but they also ensure full compliance with deeds, recordings, and legal fees and so on.

Depending on where your home is located, the closing costs could vary.

A large component of them is usually taxes:

- Local taxes such as city or county transfer taxes.

- Prorated property taxes which are calculated based on the closing date.

For example, I have a house buying company in Philadelphia. When we buy houses in Philadelphia County there is a 4.27% transfer tax on each transactions.

That is huge!

Don’t worry, it’s not that large all across the country.

On average, you can expect to pay around 2% in closing costs when you sell your home.

Moving Costs (Average: 1%)

Knowing how much profit you keep when you sell your house means knowing each and every little expense that will come up.

For some, but not all, this includes hiring movers.

While this will not apply to all transactions and sellers, it’s a fairly common cost of sale that is deducted from your net proceeds.

On average, we see around 1% of the sale price being attributed to moving costs (movers, boxes, gas, tolls, trucks, etc.)

Holding Costs (Average: 1%)

The last, but certainly not least, is holding costs.

Every month, week and day that you continue to own your home – it continues to cost you.

How so?

- Property taxes

- Interest cost

- Maintenance

- Insurance

- HOA fees

- And the list goes on…

If you are listing your house with an agent, you can expect a 6-12 month process, end to end. Depending on how long it takes for your house to sell, these costs can continue to compound over time.

On average, we see around 1% of the sale price being deducted as holding costs.

What About Capital Gains Tax?

Okay, so you made it to the closing table and got a big fat check for $50,000. Nice job, you did it. All of these home improvements, sweat equity and long nights were worth it. You sold your house for a profit.

For many, this is where the story ends. The calculator above works and you keep your $50,000.

For others, there might be more deductions in your future.

You won't know for sure until you talk to your tax professional, but if you do have a capital gains tax implication then it's certainly something you should account for.

We made a much deeper and fuller guide on how much taxes you will pay when selling your house.

It's always a good idea to consult with a real estate attorney or tax professional to fully understand your tax liability.

For the purposes of this article and the calculator above, we assumed no tax.

What Percent Of My Home Sale Do I Keep?

So, you want to sell your house.

And, you’re wondering how much profit do I keep after selling my house?

For this, you really have two options:

- You can get as much detail as possible and plug those all into the calculator above:

- How much will your realtor charge?

- What is the transfer tax in your county?

- What is your loan balance?

- Etc.

- You can know that on average, it’s about 11%. Some more, some less.

The average homeowner will keep about 89% of their home’s sale price after all selling costs are accounted for (assuming no mortgage or other debts tied to the property).

What's not accounted for in this analysis is your capital gains tax. Some homeowners who sell their house for a gain may be subject to capital gains tax.

Do You Need To Keep More After Selling Your House?

For many homeowners looking to sell, this is a surprise.

A huge amount of your home’s value can vanish in the form of selling expenses.

After all, 11% is the average amount you can expect to leave on the table when you sell your house.

However, there is a cheaper alternative!

And it doesn’t require that you sell your house at a deep discount either.

This option is better for the following reasons:

- No realtors – no fees or commissions.

- Sell your house “as is” – no repairs or cleaning.

- Fast closings – no listings or prolonged negotiations.

- Cash offer – no contingencies.

- No closing costs – zero transfer tax.

When you sell your home to a professional home buying company, like Signature Properties, you can quickly reduce your out-of-pocket expenses and keep more of the equity you have built up over time.

For example:

If you own a home that is worth $300,000, then you could either:

Sell it the traditional way and settle for your net proceeds of $267,000

-OR-

You could sell it directly to a home buyer, perhaps at a discounted price of $290,000. Your net proceeds are $290,000 or $23,000 more!

If you’re interested in selling your house without a realtor or hefty closing fees, then fill out this form for a free, no obligation cash offer from my team:

More Blog Articles You Might Enjoy

Author: Doug Greene

Doug Greene is no stranger to all topics real estate and business. For over a decade he has been educating others and helping homeowners navigate difficult, complex problems with their property.

His work has been featured in the NY Times, Washington Post, Realtor.com, Apartment Therapy, HomeLight, Homes & Gardens and many more.

Fact Checked

Fact Checked